HUGS Success Depends on Your Generosity

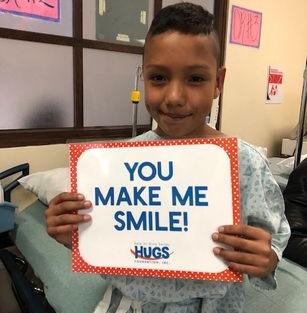

Join HUGS in Giving Smiles

HUGS Foundation, Inc. relies on donations to provide smiles to children in need in Ecuador, Guatemala, and Vietnam. Every contribution, regardless of amount, helps us provide reconstructive surgeries for these kids. If you are unable to donate funds, we also have opportunities for donating supplies and volunteering your time and talents. Contact us for other fundraising opportunities.

Over 90% of your donation goes directly towards our missions.

Other Ways to Give

Check

- Payable to HUGS Foundation

- Send to: the HUGS Foundation, Inc.

973 East Ave

Rochester, NY 14607 - Cash Gift

Gifts by Will

- A simple charitable bequest can provide very meaningful support for our mission as well as reduce the amount of estate and inheritance taxes paid.

- Bequests allow you to secure an estate-tax deduction for the value of your gift.

Gifts of Appreciated Securities

- Outright gifts of appreciated securities—stocks, bonds and mutual funds—are a meaningful way for you to help HUGS.

- You can transfer most gifts of stocks electronically from your brokerage account to our HUGS account.

Corporate Sponsorship

- If your company is interested in sponsoring an upcoming mission, we would love the opportunity to sit down and talk with you.

- On average, our trips cost between $50,000 – $75,000, which includes medical supplies, surgical equipment, medications, surgery and mission trip expenses.

- Contact us to learn more, and to find out how your contribution can benefit your company.

Remember, HUGS Foundation, Inc. is a 501(c)(3) tax-exempt organization. All donations of cash and supplies are tax-exempt to the fullest extent of the law.

Federal Employer Identification Number (EIN): 58-2673458

Thank you for helping us give smiles!

HUGS Foundation, Inc.

973 East Ave

Rochester, NY 14607

Contact

Phone: 585-244-1000

Email: info@helpusgivesmiles.org

Federal Employer Identification Number (EIN): 58-2673458

HUGS Foundation, Inc. is a 501(c)(3) tax-exempt organization. All donations of cash and supplies are tax-exempt to the fullest extent of the law.

HUGS Foundation, Inc. is a 501(c)(3) tax-exempt organization. All donations of cash and supplies are tax-exempt to the fullest extent of the law.